Our experts frequently write blog posts about the findings of the research we are conducting.

Stock Market Correlation and Portfolio Diversification

Did ARS Interest Payments Adequately Compensate Investors After the Failures?

SEC Litigation Releases: Week in Review - February 17th, 2012

Should You Cash Out Your Home Equity to Find Your Missed Fortune? Careful! A Scam Might Be On the Way

Home Equity: Changing Perspectives

SEC Litigation Releases: Week in Review - February 10th, 2012

Could Credit Rating Agencies be Held Accountable This Time?

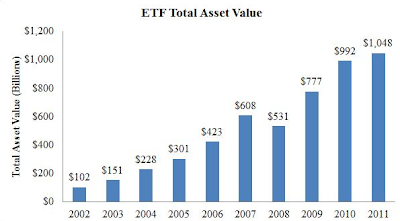

ETFs' Asset Value is Increasing, Trading Volume Remains Stable

Reserve your Clever ETF Ticker Before it's Too Late

But finding a catchy symbol can be tough these days. Many have already been taken: 1,350 symbols are in use on the NYSE Arca alone, the biggest U.S. market for exchange-traded products. That's up 108% over the past five years, says Ms. Morrison. In addition, fund firms have reserved 2,446 symbols for future...

A Wipeout That Didn't Have to Happen